A few notes from this week:

PRICES

- Last week in this update, I said two things, firstly supply will continue to come forward and secondly that prices had slowed and the next few weeks will tell us how much buyers are prepared to chase cattle with supply influencing the market.

- Both of these dynamics have eventuated within 4 days of sales following, #1 – Queensland paddock cattle are now flowing freely and #2 – prices have come under pressure due to weaker demand from feedlot and processor buyers to source saleyard cattle.

- Short term offers for paddock steers are still solid $4.00 for Angus steers and $3.80 in the short term, whilst grids are filling faster than feedlots and processors can publish them.

- I said last week QLD is driving the market, and I believe the QLD influence will be a key theme of the markets in 2024, due to the nature of the lower herd in QLD, and whether or not rain falls in the state this year will determine #1) cattle supply to market and #2) buyer demand.

- If QLD is wet this year, I believe it will have a big influence on the broader market, with QLD buyers needing to move south to access cattle if either A) paddocks can’t be mustered or B) producers choose not to sell.

- Alternatively, if it isn’t wet (which is looking unlikely) weak demand due to higher QLD supply will necessitate the need for QLD to source southern cattle and therefore place pressure on price, alongside higher supply.

MARKET BEHAVIOUR

- Multiple conversations this week have reinforced something I’ve raised a bit already this year, buyer behaviour, particularly producers being reactive to feeders and processors showing their hand.

- Fundamentally nothing has changed between this week and last week, other than supply in QLD reducing demand on saleyard cattle, with more stock sourced directly from the paddock.

- But producers are clearly stepping back from buying right across the country (even WA) –> and as a result general declines of 20c/kg lwt + were standard across the board…

- It goes to show how reactive and emotionally driven the cattle market can be… its not as if a drought just been declared or an exotic disease outbreak is here…

- This type of emotional, reactive driven behaviour is a direct result as to why the market has seen its most volatile price period since records began and its only weighing increasingly more on markets moving forwards.

- It is likely that the sooner industry adopts actual risk management tools like the swap to mitigate losing money because of an emotionally driven market, the more sustainable the beef industry can be for the long term.

- Take an average 400kg feeder steer, based on NLRS prices and selling 100 head, a seller between this week and last would have lost $7,500…

SUPPLY

- Although supply tightened in the yards, paddock cattle availability strengthened, reducing demand at the saleyards.

- Looking ahead, numbers will continue to flow, watch producers react to a falling market and look to sell before “cheaper prices next week”

- As a result of the cheaper prices next week mentality, processor and feeder grid prices will continue to fall in line with that –> which some have touted and acted on already.

NEXT WEEK

- ABS release Q4 2023 slaughter and production data next Tuesday 20th, this will provide full year picture of how 2023 played out.

- I’m expecting cattle slaughter to reach between 6.9-7.05 million head for the full 2023 calendar year.

- Production will be the highest since 2019, somewhere between 2.15 and 2.25 million tonnes (carcase weights the key factor to the higher production despite lower slaughter volumes than 19’)

- I’ll do a full analysis on these figures which will include the Female slaughter rate and the stock turnoff ratio, these two metrics are lead indicators of the herd growth/liquidation cycle.

- I don’t expect the cattle herd really liquidated at all in 2023, despite what others suggest, utilising the FSR rate as the sole metric doesn’t paint the entire picture of where numbers are at which is why we need to consider actual #’s of females killed. And actual numbers relative to the 2019 drought liquidation will be well down.

WEATHER

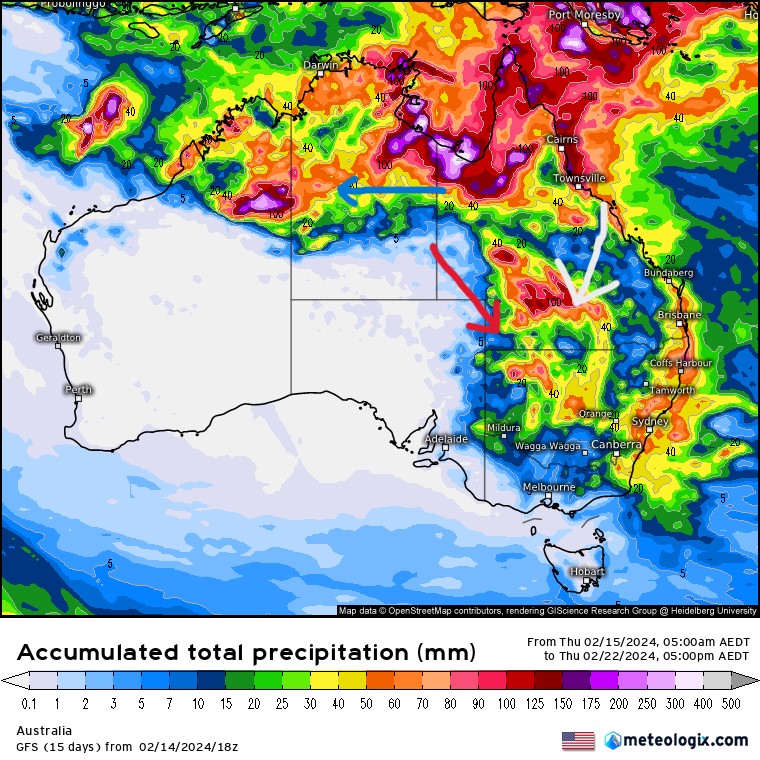

- The GFS accumulated rainfall forecast to next Thursday is below, indicating the Gulf is in for more heavy falls, I’m told good numbers of cattle were moved to higher ground in preparation for TC Kirrily, here’s hoping those stock and people remain safe.

- More rain forecast for central and western QLD into the channel country + far northwest NSW.

- That rain is a result of winds pushing the bottom half of the gulf low south into the QLD/NW NSW interior

- The NT is expecting further solid falls in the next week, across the VRD (Victoria River District) and Barkly Tablelands, adding to the big rain received in W3 January.

- Fortunately this is helping the live export trade for the time being with the Indonesian presidential election taking place, holding cattle in paddocks destined for Indonesian feedlots.

- Once permits are finalised, live export numbers should begin to flow in earnest.

- The rain forecast for the NT and Kimberley is the Gulf low tracking west, expect this to develop as time progresses and track further west down into WA – satellite images have identified this already even if the models haven’t.

- A low off the north coast of WA is developing, from late next week this should influence the system WA is in for in the back end of this month.

Kind Regards,

Ripley

Report by Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61-427-796-984

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

Revised Disclaimer for SFPL

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727) (“SFPL”) is a member of the StoneX Group Inc., group of companies. The StoneX Group Inc., group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC. (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX Financial Ltd (“SFL”) is registered in England and Wales, Company No. 5616586, authorized and regulated by the Financial Conduct Authority [FRN 446717]. StoneX Financial Pte. Ltd. (“SFP”) (Co. Reg. No 201130598R) holds a Capital Markets Services Licence regulated by the Monetary Authority of Singapore for Dealing in Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading. SFPL holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646). StoneX Financial (HK) Limited (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Futures Contracts. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors.