Good morning,

A few notes from this week:

KEY POINTS

- Queensland is driving the cattle market currently despite stronger supply, robust demand from the state on the back of rain driving improved confidence.

- Angus to Flatback feeder steer price spreads are remaining tight, supply, weak demand and feedlots chasing a different article the influencers.

- The BOM declared the end of the Positive IOD this week.

SUPPLY

- Its not new news but QLD is driving this cattle market, without question.

- Rain has fallen in the state, the rebuilding intentions are there and demand is extremely solid. Expect QLD to continue to flex its muscles across this east coast market chasing cattle, both for feeding and back to the paddock cattle.

- Nationally, Restocker steer and heifer prices are at their highest levels since Mid April 2023, Restocker steers kicked another 12c this week, following a 32c/kg lwt rise last week, as above, QLD is driving the market.

- I thought last week processors would compete heavily on cows, with the US export demand solid, driving prices back to year ago levels. This didn’t eventuate, with processor stock the categories to see prices soften up this week. Restocker & feeder prices continued their merry march north.

- The Argus Flatback feeder steer price jumped 23c last week to 379c, whilst the spread remaining tight between Angus feeders and flatback feeders, +11c/kg lwt for Angus. I believe there’s a few reasons influencing this historically tight spread remaining.

- 1. Feedlots are chasing higher turnover on shorter fed cattle – not programs you would generally associate with Angus.

- 2. Anecdotally, moving product on the export side is challenging with subdued demand, feedlots may be biding time to watch demand adjust before committing heavily to big Angus numbers destined for branded programs, couple this with expensive grain…

- 3. The supply of Angus or Angus infused calves in the herd at the minute (without data) would be close to touching historical highs, thus, due to higher supply, prices are necessitated to be find upward pressure.

EXPORTS

- January export volumes came out this week with 75,585 tonnes exported, the strongest start to a year we’ve had since 2020.

- The US as mentioned in this email last week stepped up, doubling volumes from January 2023 to see 20,308t exported.

- Encouragingly other key high value markets we compete with the US in, being Japan and South Korea also had solid starts to the year. Continue to watch how exports to these markets play out, providing critical insight into how the pullback of US production tracks throughout the year.

- I had a brief look at late 2023 export volumes compared to the big years of 2014 and 2019, I’d be prepared to say within the next 12 months we’ll see those monthly beef export records broken with the way supply is tracking, ever improving processor throughput, higher beef production and the growing middle class needing to be fed demanding our product. To me it’s a matter of when not if.

WEATHER

- The BOM quietly declared that the Indian Ocean Dipole (IOD) which is a key driver of southern Australia’s weather & rainfall patterns has returned from positive to neutral levels this week.

- A positive IOD = “often resulting in less rainfall and higher than normal temperatures” in BOM’s words.

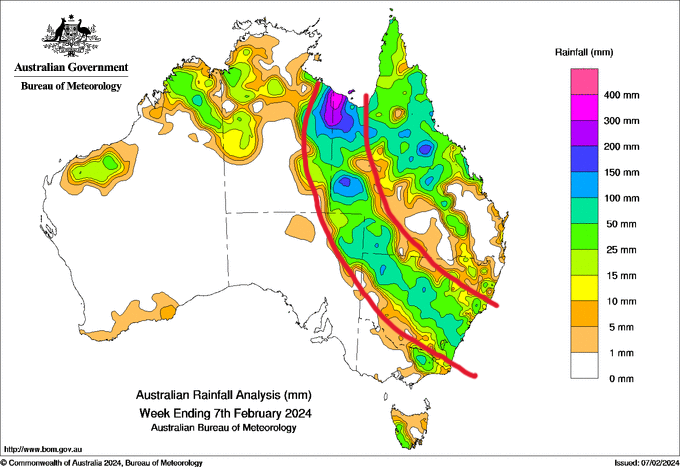

- The rain forecast from the GFS model last week largely eventuated after ex TC Kirrily returned from the Gulf, with falls of an inch plus common throughout its path and a lot more in places. See below:

- Looking ahead, the next major weather pattern for the country is expected to eventuate in early – Mid march. Into Week 3 of February, WA is in for rain following a low forming in the western Indian Ocean –> this will track east across the continent and may deliver solid falls for Eastern Australia as well.

- Watch this space.

Kind Regards,

Report by Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61-427-796-984

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

Revised Disclaimer for SFPL

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727) (“SFPL”) is a member of the StoneX Group Inc., group of companies. The StoneX Group Inc., group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC. (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX Financial Ltd (“SFL”) is registered in England and Wales, Company No. 5616586, authorized and regulated by the Financial Conduct Authority [FRN 446717]. StoneX Financial Pte. Ltd. (“SFP”) (Co. Reg. No 201130598R) holds a Capital Markets Services Licence regulated by the Monetary Authority of Singapore for Dealing in Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading. SFPL holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646). StoneX Financial (HK) Limited (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Futures Contracts. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors.