Good morning,

A few notes from this week:

KEY POINTS

- Confidence is king, and this market continues to strengthen as a body of feed and full dams bring buyers back to the rail to compete. With rain extending into areas that needed it, expect this market (particularly restockers) to continue to find support.

-

US data indicating demand for Australian beef has kicked the year off very strongly, with the expectation this will continue as lean beef supply tightens as the year progresses.

-

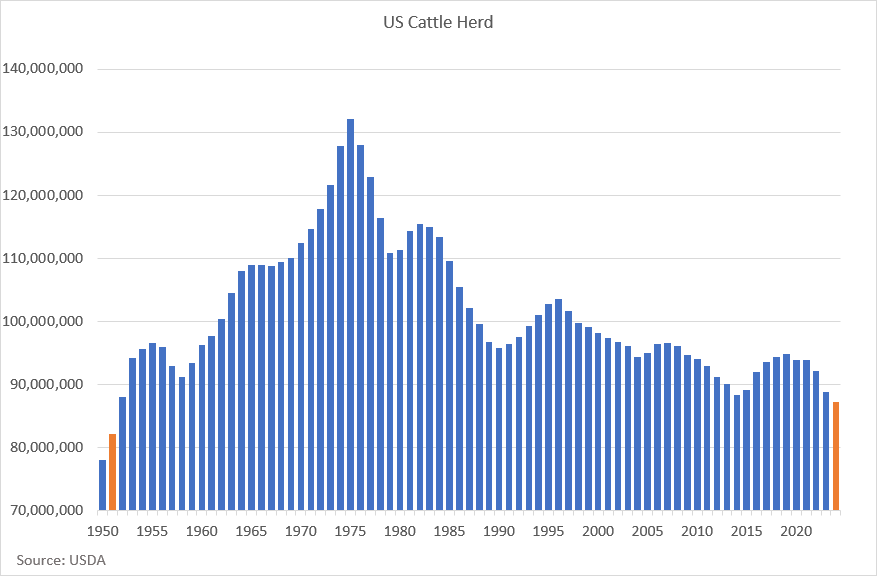

The United States cattle herd on 1 January 2024 has reached its lowest level in 7 decades or since 1951

SUPPLY

- Supply has moved the way you would expect for QLD & yards north of Scone after the rain in the last week. With ex TC Kirrily remaining in QLD into the end of next week, the continuation of tighter supply looks set to stay.

- Conversely, south of Scone, a dearer market has seen producers react (FOMO again) and supply has risen, a tale of two halves as they say.

- Slaughter was subdued due to shortened Australia day working week –> tighter supply expected to continue for slaughter cattle moving forwards as I mentioned last week, Jon Condon at Beef Central reiterated this in his Tuesday Weekly kill report following conversations with industry stakeholders. See quote below:

- “Some Queensland beef processors have already declared closure for days this week, whilst others are uncertain about raising kills between now and Friday, and potentially into next week.

- Several said without further rain it still could be mid-February before operations get back to normal”

PRICES

- Confidence and in turn sentiment is key at the minute, with the market closing the week stronger again, the 4th in a row to kick off 2024.

- I expect this to continue next week, seemingly expensive grain, weaker grid prices not reflecting the livestock market and softer beef prices are doing little to dampen demand at the feeder and finished end of the market so these rises should continue in that space too.

- Rain across QLD drove restocker price improvements to end the week much higher than the national picture. QLD steers to go back to the paddock ending the week 32c/kg lwt dearer.

- Looking at year ago levels, we may see processor cow prices end next week nudging year ago levels, the first time any indicator will have surpassed year ago rates in some time.

- I mentioned volatility last week and it really shows, it took 7-8 months for the market to reach its low and within the space of 3 months the market is now within touching distance of yearly highs, and it comes down to confidence driven by weather and not much else.

US CATTLE HERD

- The annual US cattle herd survey was released overnight by the USDA and the numbers demonstrate what 5 consecutive years of destocking does to the largest beef producing country in the world.

- Total herd size fell 2% to 87.2 million head, the lowest the US herd has been since 1951.

- The number of cows fell to 28.2 million head, the lowest since 1961.

GLOBAL UPDATES

- As per Steiner’s Weekly Market report – US imports of Australian beef for WE 20th January were 138% or 5,800 tonnes higher compared to the corresponding week in 2023.

- To back this up, US cow/bull slaughter is down 17% (estimate) year-on-year for the past 4 weeks, in Steiners words “ significantly limiting lean beef supply” -> couple this with a forecast of double digit decline in cow meat supply and the indicators for robust demand from the US for Australian grinding beef exports is there for all to see.

- A strong recovery in cow/bull slaughter will be required to limit demand for cheaper imported Australian 90CL beef.

- Thus, demand moving forwards for processor cows should remain strong as those exporters locked into the American market begin to feel demand shifts (as we know Mince is kind during a cost of living period that challenges the household budget).

- This is a watch and see dynamic moving forwards in terms of its influence on processor cow prices.

- Steiner are expecting the US’ “Other” quota to be filled by early March, with its entries already at 60% of quota capacity, driven by Brazilian imports.

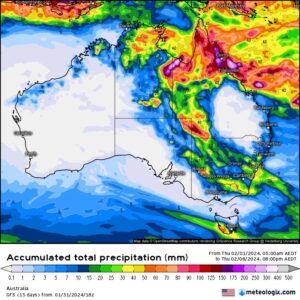

WEATHER

- Ex TC Kirrily expected to continue delivering widespread rain into the end of next week across inland QLD, with the stormy nature of the system making rain patchy

- This is the major system operating in the country at the moment –> little rain is forecast for WA over the next week, the mid-end of Feb is where WA’s next pattern will step up.

- As mentioned previously, if this rain proves to be fruitful and not damaging, large cattle regions in QLD will be extremely well set up for 2024, I expect the northern herd to grow strongly this year.

- A number of models for the next week are forecasting ex TC Kirrily to circle down through the channel country into far western NSW and across the north and central west of the state. Keep an eye on whether this plays out as it may extend the tightening of supply into broader NSW and place further upward pressure on prices if solid falls eventuate.

- GFS Forecast to next Thursday 8th February below:

Kind Regards,

Kind Regards,

Report by Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61-427-796-984

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

Revised Disclaimer for SFPL

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727) (“SFPL”) is a member of the StoneX Group Inc., group of companies. The StoneX Group Inc., group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC. (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX Financial Ltd (“SFL”) is registered in England and Wales, Company No. 5616586, authorized and regulated by the Financial Conduct Authority [FRN 446717]. StoneX Financial Pte. Ltd. (“SFP”) (Co. Reg. No 201130598R) holds a Capital Markets Services Licence regulated by the Monetary Authority of Singapore for Dealing in Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading. SFPL holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646). StoneX Financial (HK) Limited (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Futures Contracts. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors.