Good morning,

A few notes from this week:

KEY POINTS

- Queensland restocker heifer prices improved strongly this week on the back of higher supply, indicating solid demand for females to rebuild numbers in the state.

-

Expect slaughter volumes in coming weeks to decline, with a shortened week this week and Cyclone Kirrily affecting supply in QLD.

-

Cattle prices in the past 6 months have been the most volatile on a quarterly basis on record

PRICES

- The market has continued to improve this week, with some young cattle in centres now averaging over 400c/kg lwt, the first time this has been seen since May 2023.

- In the Indicator table below, you’ll notice prices have improved, although not to the extent of the 40c and 20-25c/kg lwt rises seen in the past fortnight.

- In QLD this week, restocker yearling heifers rose 23c, 5c/kg lwt more than the national lift. Watch the demand for heifers/females in Queensland and QLD buyers heading south to access females moving forwards.

- QLD still have some way to go in rebuilding numbers, and therefore with rain forecast I believe demand for current or future breeding females in QLD will strengthen as producers look to grow numbers with a good season.

- Which in turn will see the herd grow again in 2024 due to this dynamic.

- Looking ahead, with the weather forecast, I see prices continuing to lift, particularly on the restocker side, with renewed confidence from a body of feed and rain for some on the way.

SUPPLY

- Slaughter numbers lifted 27k last week, to 116,113 head, this figure represented a 17% or 16,900 increase the corresponding week last year.

- Numbers will fall when figures are released next week due to Australia day shortened week.

- Moving forwards, watch numbers in QLD decline due to Cyclone Kirrily impacting the supply chain in a few ways, particularly CQ plants, transport access and ability for stock to be mustered, as well as producers wait and see approach to the market moving/ holding to add weight.

- Yarding’s were solid again, 10k head higher than the 2-year weekly average, continuing to show producers playing their hand of not wanting to miss out on the market (FOMO) and also reaffirming the number of cattle around.

- As mentioned above, watch Queensland and northern NSW supply over the next fortnight, if the remnants of cyclone Kirrily deliver what is forecast, expect numbers to tighten as producers retain stock for either breeding or weight gain.

DEEP DIVE

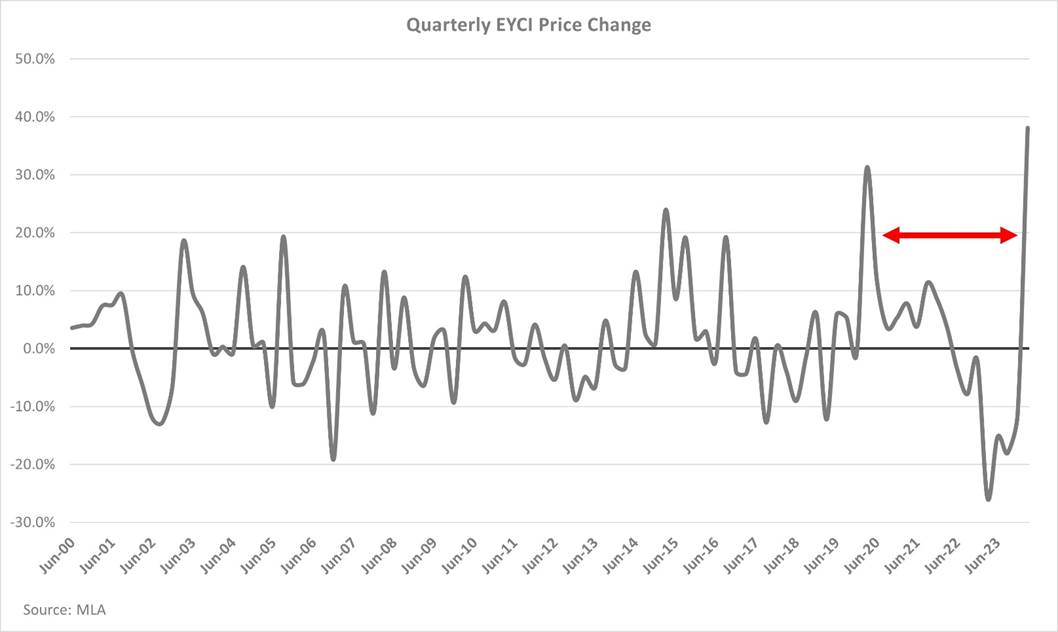

- Considering market volatility this week, I charted the EYCI price change on a quarterly basis back to 2000. I used the EYCI as it’s a reasonable barometer of prices paid from different segments of the market, being producers, feedlots and processors and although the EYCI isn’t a tangible animal, it does incorporate large numbers of stock with different buying groups giving a strong indication of market sentiment.

-

The chart below shows how volatile prices have been in the past 4 years, with Q1 2024 showing the largest price change increase in the EYCI since 2000 (admittedly we’re only 25 days into the new quarter).

- Whilst Q3 2023 represented the largest price change decrease since 2000, simply put, in the space of 6 months, Australia’s cattle industry in price terms has been the most volatile since records began.

- It would be remiss of me to say “on record” because no doubt that won’t be the case by the end of the decade.

- These price changes continue to reaffirm how important risk management is and highlights how the StoneX Australian feeder cattle swap can be utilised to mitigate and manage the risk the cattle market carries

WEATHER

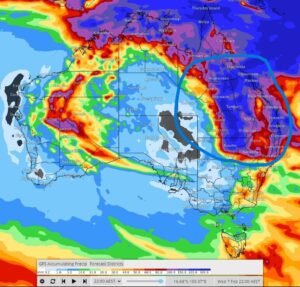

- Last week I mentioned minor/flash flooding in the NT with more expected on the way, and a lot more came. See BOM weekly rainfall totals in the NT to 22nd January below

- The Victoria River has broken its 1991 flood record this week, at the Vic Highway crossing, water reached 23.95 metres at its peak, 3 metres above the bridge height.

- This rain was widespread, right down to Helen Springs on the Barkly, receiving 10 inches over the past week. More is on the way moving into next week.

- These falls will continue to provide support for further herd rebuilding in the territory, where numbers can lift quickly due to the volumes of breeding females.

- The latest GFS forecast to 7th February is below, I expect supply of cattle to tighten if this forecast delivers. Both lower general supply and major implications for Queensland processing facilities and producers looking to get cattle off farm. Slaughter numbers may take some time to recover due to this weather system in terms of accessibility to cattle supply into mid – late February.

- This rain is the remnants of Cyclone Kirrily which is expected to make landfall tonight around 10pm or in the early hours of tomorrow near Mackay, QLD.

- This rain will set up large swathes of QLD cattle country to continue to rebuild and or grow numbers in 2024 (operation dependent), a positive for the national herd’s growth in 2024 as this will continue to contribute to solid demand for cattle in Queensland, particularly current or future breeding females.

- Falls of 250mm + for the interior of QLD are likely into the channel country, and as a result flooding may occur.

Next week I’ll have content and calculations to share on how the swap could have protected margins in 2023 against a falling market and conversely how the swap operates on a rising market whereby a user would make money on the physical cattle and lose on the swap.

Kind Regards,

Report by Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61-427-796-984

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

Revised Disclaimer for SFPL

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727) (“SFPL”) is a member of the StoneX Group Inc., group of companies. The StoneX Group Inc., group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC. (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX Financial Ltd (“SFL”) is registered in England and Wales, Company No. 5616586, authorized and regulated by the Financial Conduct Authority [FRN 446717]. StoneX Financial Pte. Ltd. (“SFP”) (Co. Reg. No 201130598R) holds a Capital Markets Services Licence regulated by the Monetary Authority of Singapore for Dealing in Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading. SFPL holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646). StoneX Financial (HK) Limited (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Futures Contracts. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors.