Good morning,

On Monday, MLA released the November 2023 wave of the beef Producer Intentions Survey (BPIS). The survey captured over 3,750 responses from Beef Producers in every state and territory in Australia. The results are split across Northern & Southern production systems and by state and levy payer size to provide more accurate and specific results relative to a producer’s scale and location.

The below breakdown of the results provides a good overview of the survey although there is are significantly more insights and data to be taken away from the survey. I’d encourage you to take the time to read the document in more detail. It is a great piece of work that should look to inform the industry on key performance metrics with accurate figures in the future to better inform the industry on key data points of importance.

The survey had three primary objectives when I developed it with Intuitive (survey provider) in 2023.

- Measure and report on herd demographics, population, supply and producer intentions.

- Ensure the sample utilised to generate the figures was robust enough in size to ensure accuracy of results.

- Provide capacity for insights to be gathered at a more detailed level, and also to provide new insights which the beef industry hadn’t seen before, e.g. breeding female by breed, sales intentions and channels.

Measure and report on herd demographics, population, supply and producer intentions

Ensure the sample utilised to generate the figures was robust enough in size to ensure accuracy of results.

Provide capacity for insights to be gathered at a more detailed level, and also to provide new insights which the beef industry hadn’t seen before, e.g. breeding female by breed, sales intentions and channels.

To read the full report, click the link here.

If you would like to discuss the BPIS results in more detail, give me a call or send me an email.

KEY POINTS

- When including calves, the survey estimates there were 35.65 million head of cattle in Australia in November 2023.

- 24.22 million adult cattle

- 11.94 million head in northern Australia

- 12.28 million head in southern Australia

- 11.43 million calves either born or expected to be born before 31 December 2023.

- 24.22 million adult cattle

- There were 77,407 agricultural businesses with grassfed cattle in November 2023.

- Nearly 70% of sales from a cow/calf producer in Southern Australian production systems are expected to be made in H1 2024 – indicating robust cattle supply to the middle of the year out of the south.

- Northern Australian cattle producers were more optimistic about the outlook for the next 12 months than Southern Producers, +26 compared to +7

- Remembering these results were collated in November 2023, prior to widespread rain adjusting both the market and general industry sentiment.

PRODUCER SENTIMENTS & INTENTIONS

- Generally, sentiment was subdued when surveyed, unsurprisingly considering the cattle markets of 2023 and for some, seasonal condition challenges. Overall, net sentiment (positive sentiment – negative sentiment) at a national level was +12

- Southern producers net sentiment was +7 –> with the dry conditions (for some) and the reverberation of negative sentiment driving the market lower causing this outlook.

- Northern producers net sentiment was +26

- Northern Australian and larger producers were more optimistic about the next 12-month outlook compared to their smaller or southern Australian counterparts.

- I believe this is more to do with the southern producers significantly more impacted by the market downturn and the drier seasonal conditions pushing their sentiment much lower than northern producers being overtly optimistic.

- Nationally (these figures were generally the same across both production systems);

- 38% intended to increase numbers

- 15% expected no change

- and 47% intended to decrease numbers.

- As mentioned before, the dry seasonal conditions will have an adjusted impact on these results due to the survey’s timing.

- I believe the April wave of the survey will show more intent from northern Australia to grow herd numbers.

SALES OUTLOOK

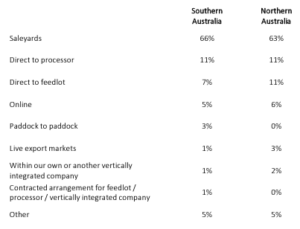

Smaller producers were typically selling into 1 channel, whilst larger producers had a diversified sales channel mix they sell into – assumedly to better manage price and market risk.

BREEDING FEMALE DEMOGRAPHICS & PERFORMANCE

- Angus, Hereford & Shorthorn are the largest breeds by breeding female in southern Australia, accounting for 83% of the total breeding females in the south

- Brahman, Droughtmaster & Ultrablacks/Brangus are the largest breeds by breeding females in northern Australia, accounting for 64% of total breeding females in the north

- There are around 700,000 Wagyu breeding females (has more than 51% Wagyu content) in Australia.

- 32% of heifers are culled on average across both north and south.

- Calving Rates

- Heifers 77%

- Cows 87%

- Southern Australia seasonal joining

- 38% run a split calving across Autumn & Spring

- 38% are Spring only

- 24% are Autumn only

- WA is overwhelmingly Autumn calving focussed, with 75% of WA producers saying they only calve in Autumn.

- 67% of the breeding herd is aged between 2 and 6 – indicating the herds younger age with more a more productive, genetically enhanced makeup.

- 76% of producers across the country focus on cow/calf production only with 13% being traders only and a further 11% running both trading and breeding cattle.

Kind Regards,

Report by Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61-427-796-984

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

Revised Disclaimer for SFPL

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727) (“SFPL”) is a member of the StoneX Group Inc., group of companies. The StoneX Group Inc., group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC. (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX Financial Ltd (“SFL”) is registered in England and Wales, Company No. 5616586, authorized and regulated by the Financial Conduct Authority [FRN 446717]. StoneX Financial Pte. Ltd. (“SFP”) (Co. Reg. No 201130598R) holds a Capital Markets Services Licence regulated by the Monetary Authority of Singapore for Dealing in Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading. SFPL holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646). StoneX Financial (HK) Limited (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Futures Contracts. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors.