Good morning,

A few notes from this week:

KEY POINTS

- Weaker calf prices and challenging weather conditions are seeing a continuation of herd liquidation in Brazil.

- Smart buyers have been capitalising on strong restocker heifer to steer price discounts, whilst QLD demand for future breeding females this week was red hot.

- The first signs of stronger US demand for our 90CL product due to a reduction in cow and bull slaughter volumes appear to be supporting higher Processor Cow prices in Australia.

BRAZILIAN UPDATE

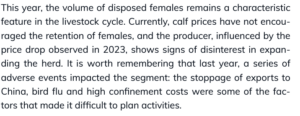

- Our Brazilian team have released their Q2 2024 outlook on the cattle market in Brazil and have some interesting things to note on how its market is performing and what this means for the major beef producing country moving forwards

- If you’re interested in accessing these types of insights and market information on an array of other commodities and global markets across the globe which StoneX is intimiately in touch with, contact me.

- With a liquidating herd and a lack of signals from improving calf prices or weather conditions to incentivise rebuilding, the herd in the minds of our Brazilian Brokers expect liquidation and high kills of females to continue.

Source: Brazilian Quarter 2 Commodities Outlook

- ↑↑↑Content on the current dynamics of the Cattle industry in Brazil from our Brokers on the ground –> all available in the Q2 2024 Brazillian Commodity outlook from StoneX.

- Generally the market has remained stable to begin 2024 although drought conditions and high feed costs for feedlots are problematic for the sector at the minute.

- My view on Brazil over the long term –> talking 5 years plus, is that the Brazilians are going to become a major competitor to Australia moving forwards;

- Why do I think this –> Lower labour costs, lower cost of production, more reliable climate, higher cattle numbers producing beef at a cheaper price than us, more consistent production through the growth in lot feeding –> it all points to a big challenge for Australia.

SUPPLY

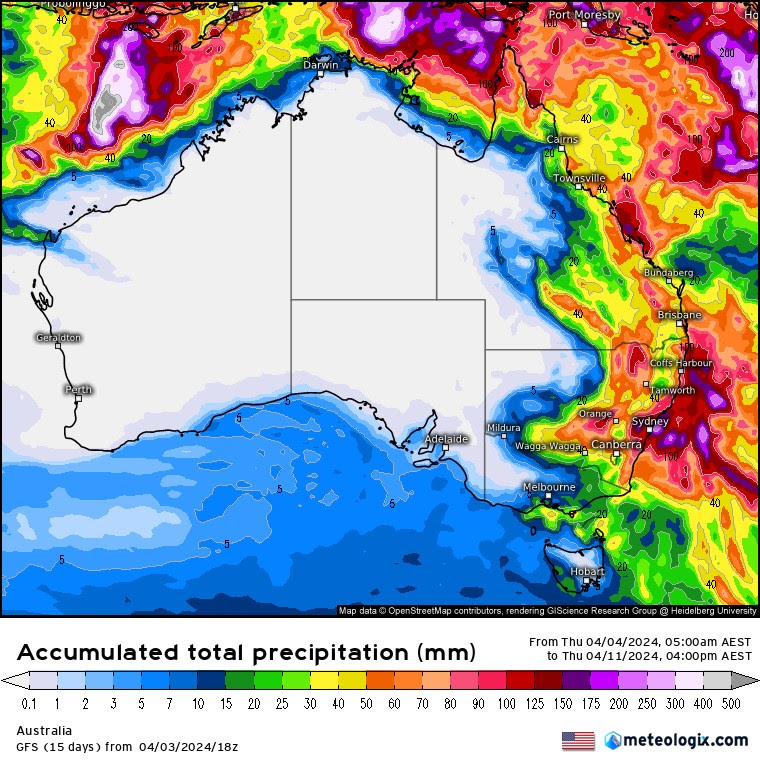

- On the home front, you only need to look at the weather on the east coast to explain supply.. this is the second consecutive week of the tightest cattle supply since October-23’ (Barring early Jan-24’)

- Yes Easter has played a role, but rain across a lot of places that did really need it has also played an important role. Producers are sitting on their heels happy to hold and add weight.

- Slaughter numbers nationally (108,000) compared to the corresponding easter weekend in 2023 were higher by 22,000 head (based on NLRS) showing the improvement made in 12 months in throughput in the plants.

- QLD processing numbers were higher by 26,000 head compared to the shortened Easter week in 2023.

- Looking ahead –> if this system hitting the east coast from today into the week delivers the forecast rain, I expect numbers to remain tight next week and a further lift in prices, watch this space with feedlots and processors reacting to a rising market and how much or how little they are active in the market buying stock as a result of two solid weeks in terms of price improvements.

HEIFERS IN STRONG DEMAND

- When you look at pricing data for heifers compared to steers to go back to the paddock over the last 15 months , heifers have been priced much cheaper than steers.

- At the minute nationally, restocker heifers are operating at a 33% or 81c/kg lwt discount to steers. This is much higher than the 4 year average of 17% or 61c/kg lwt.

- In dollar terms on a 250kg animal at current prices, that equates to $205/head discount for heifers.

- What this says is a few things, numbers of breeding females are high, and producers are taking more conservative approaches by trading steers.

- What happens when you add in QLD buyers to the mix looking for cattle to restock paddocks and or rebuild numbers, is the demand for heifers on the back of rains strengthens quite strongly.

- A number of cattle buyers and producers have recognised the discount heifers have been operating at for some time and are capitalising on this dynamic, buying good numbers of heifers for a comparitively cheaper rate.

- At the minute nationally, restocker heifers are operating at a 33% or 81c/kg lwt discount to steers. This is much higher than the 4 year average of 17% or 61c/kg lwt.

- These results aren’t exlusive to the normal weekly markets either, with the Armidale weaner sale today called 20-30c/kg lwt dearer on the heifers, the strongest performing category at the sale.

- Nationally, heifer prices this week lifted 28c, outperforming the general market improvement, from feeder prices remaining flat to the restocker heifers at a 28c/kg lwt lift.

- A lot of this improvement I put down to rain induced demand to rebuild numbers, take QLD for example, its heifer price kicked 30c whilst NSW heifer prices only rose 8c/kg lwt. This tells you QLD demand for heifers to grow female numbers is robust.

PRICES

- Reduced supply and confidence following rain has seen improvements across the board in pricing terms throughout the eastern seaboard (no sales in WA this week). ‘

- Feeder prices were flat which is interesting, downward pressure had been placed on grids although the paddock market has picked up this week, meaning cattle may have been pre booked and mustered out of the paddock before the rains satisfied, requirements for the week.

- The US Domestic to Imported Australian 90CL continues to widen and I think we may be beginning to see genuine evidence of this impact flowing through to Processor Cow prices on the livestock side here in Australia.

- US buyers are increasingly looking to the export market from Australia to source grinding beef due to the costs of the domestic product, some are also looking at this to secure supply leading into the US spring and summer.

- Moving forwards –> next week I see more upward pressure on prices, particularly the cattle going back to the paddock. Feeders and finished buyers may need to follow to source supply because I think producers will be happy to sit tight with cattle now that rain has fallen.

WEATHER

- This rain will play a big role in setting up large parts of the eastern seaboard moving into winter. This is important, a lot of the key cattle regions are summer dominant in rainfall and if producers have been fortunate enough to plant one, an oats crop in the ground will benefit greatly.

- I do expect good numbers of heavy slaughter cattle to be made available into winter, particularly out of Queensland following the excellent season much of the state has had so far. Big numbers of grassfed bullocks and good volumes of cull cows!

- The system that came from below Tasmania and tracked into Victoria has delivered genuine drought breaking rain for the apple isle, with conversations I’ve had stating that the country has responded well already in time for Winter.

- The autumn break many in Victoria were looking for has seemingly arrived, with more forecast over the coming days.

Source: Australian Bureau of Meteorology

- Looking ahead, the consensus on the weather is that the next major system is due in Late April and expected to run well into May. Potentially causing problems for planting of the winter crop. Although our Physical Brokers here in Australia believe big acres of crop are due to go in, although producers are showing reluctance to sell on the basis of wanting to see the crop germinate.

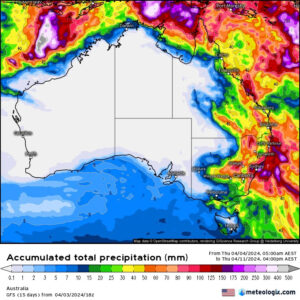

- Weekly forecast for the GFS below – providing some much needed dry weather for most of the north, allowing sunshine to do its thing. Large parts of NSW into eastern VIC will benefit further from this rain, expect this to hold cattle back from market and support higher prices next week.

Source: GFS – Australian accumulated total precipitation.

Kind Regards,

Report by Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61-427-796-984

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

Revised Disclaimer for SFPL

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727) (“SFPL”) is a member of the StoneX Group Inc., group of companies. The StoneX Group Inc., group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC. (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX Financial Ltd (“SFL”) is registered in England and Wales, Company No. 5616586, authorized and regulated by the Financial Conduct Authority [FRN 446717]. StoneX Financial Pte. Ltd. (“SFP”) (Co. Reg. No 201130598R) holds a Capital Markets Services Licence regulated by the Monetary Authority of Singapore for Dealing in Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading. SFPL holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646). StoneX Financial (HK) Limited (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Futures Contracts. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors.