Good morning,

A few notes from this week:

KEY POINTS

- MLA’s new cattle indicator specific to restockers called the NYCI was released last week, is published in c/kg lwt and has a direct correlation of 87% with the EYCI.

- A more accurate reflection of restocker prices, you can’t buy an EYCI and the NYCI incorporates Australia wide saleyard + online restocker transactions.

- Processor cow prices reaching monthly highs suggest cautiously the US demand for imported 90 CL product is flowing through to cow prices in Australia.

- Expecting supply to ramp up moving forwards post beef week, with musters getting underway and little on the radar in the way of rain.

PRICE

- MLA’s new National Young Cattle Indicator (NYCI) was released last week – published in c/kg lwt incorporating saleyard + online transactions Australia wide.

- Link to NYCI dashboard –> https://www.mla.com.au/prices-markets/cattle/nyci/

- I think the NYCI moving forwards would provide a better indicator of young cattle prices than the EYCI, particularly because it isolates restockers but captures a national picture, giving better/broader signals on market confidence without including other buyers less dictated to by the weather.

- At least with the NYCI in c/kg lwt it actually reflects the way cattle are transacted in the market, including broader scope of online sales which almost always go back to the paddock is also a good move.

- The weekly rainfall chart below is a good barometer to explain how the market played out this week, dependent on where the rain did or didn’t fall, NSW experienced the strongest change whilst QLD was firm. WA had a positive week particularly with restocker cattle.

- Unsurprisingly it’s for the finished end but this week for the first time we saw Processor cow and Heavy steer prices above the same week 12 months ago.

- The corresponding week last year was around the time when the market began its downward softening before spiralling into a plummet… expect in coming weeks and months for other indicators to move above year ago levels as the rate of the fall from 2023 moves faster.

- Processor cows to their highest price in a month and rose 8c despite supply jumping by 2,300 head, I’m cautiously suggesting the influence of a stabilisation in US 90s is supporting an improvement in domestic prices for cows following a couple of weeks of gains.

- Not so much the same for heavy steers –> I believe this has more to do with supply direct out of the paddock, particularly Queensland as musters get underway.

SUPPLY

- Mixed bag in terms of supply this week, NSW supply highest in a month, which offset falls in WA and VIC and no change in QLD.

- Lower supply in VIC and WA explained by the rain these regions received over the last week – see map below.

- Now that Beef is over and everyone is home, I’ll be watching northern NSW/QLD yardings closely next week to provide the indication of if we’re going to see cattle start flowing.

- With the weather forecast for little to no rain on the eastern seaboard I think good volumes are going to start moving pretty quickly.

- This should translate into both higher yardings and slaughter volumes.

- ABS data released today confirmed 18% difference in Q1 2024 between NLRS and ABS – meaning add 18-20% on weekly NLRS volume to get an estimate of the actual weekly slaughter rate.

WEATHER

- Weather forecaster I follow is calling a negative IOD to be active by mid-July– despite what others are saying the Indian Ocean is lining up to create a negative IOD which later in the year will drive the rain not the La Nina.

- Last week of rainfall totals below –> providing a good explanation of why cattle prices in states performed differently this week

Source: Bureau of Meteorology

Source: Bureau of Meteorology

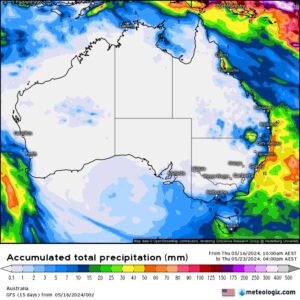

- Looking at the GFS forecast to next Thursday, little in the way of rain is telling me good numbers of cattle will begin to flow

- Northern musters starting to ramp up post Beef week and in southern states the continued turnoff of empty and cast for age cows as preg testing continues + other stock to go before winter.

Source: meteologix.com

Kind Regards,

Report by Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61-427-796-984

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

Revised Disclaimer for SFPL

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727) (“SFPL”) is a member of the StoneX Group Inc., group of companies. The StoneX Group Inc., group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC. (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX Financial Ltd (“SFL”) is registered in England and Wales, Company No. 5616586, authorized and regulated by the Financial Conduct Authority [FRN 446717]. StoneX Financial Pte. Ltd. (“SFP”) (Co. Reg. No 201130598R) holds a Capital Markets Services Licence regulated by the Monetary Authority of Singapore for Dealing in Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading. SFPL holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646). StoneX Financial (HK) Limited (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Futures Contracts. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors.