Good morning,

A few notes from this week:

KEY POINTS

- Unsurprisingly, markets copped it this week, supply used as the lever by buyers to justify price falls anywhere from 7c-36c/kg lwt week-on-week.

- Although supply is key –> Quality always pays and conversations/ reports justify this position in terms of secondary quality drafts receiving the heaviest discounts.

- In a months’ time when ABS data is released, the industry will hang its hat on the female slaughter rate % figure to ascertain whether the herd is liquidating or rebuilding –> I’d encourage you to take a different approach and look at actuals.

- Confirmed that the last 6 months of cattle prices were the most volatile since records began and it’s looking likely that volatility will continue into 2024.

- Hedging risk moving into winter with the StoneX Cattle Swap may assist all parts of the market, helping them avoid difficulties of the last few years with significant swings in prices over relatively short periods of time, exactly what happened in 2023 into early 2024.

ABS Q1 2024 DATA

- ABS slaughter & production figures will be released on Thursday 16 May, showing how Q1 2024 performed.

- A lot of people are going to focus on the Female Slaughter Rate (FSR) and what that herd percentage number is will drive commentary around whether the herd is liquidating or rebuilding, some of which already are.

- I personally don’t solely focus on this figure as I’ve said before, I’ll look at the actual kill numbers rather than the % figure to ascertain where the herd is at;

- My belief is the herd will be growing, with big retention of females in northern Australia and the southern herd will remain stable and grow mildly.

- The difficulty in measuring QLD herd change is because the state processes big volumes of grainfed cattle (majority being steers) the figures are skewed, so even using a state-based metric is problematic.

- I did some analysis on this at MLA and NSW tracks the national FSR % figure the closest on average since 1976 –> if you really want to use a % number, I’d suggest the NSW rate.

- I’ve mentioned the above factors a month out from the ABS Q1 release because I know the industry will hang its hat on the % FSR figure –> a more balanced approach is needed when looking at the state of the herd.

- Another fact: The 47% FSR rate everyone uses for whether the herd is rebuilding or liquidating is actually the quarterly average of the female kill percentage since 1976.

- It is not an analysed number which determines liquidation or rebuild, people just use it that way.

WEATHER & MARKETS

- Been thinking a bit this week about the landscape further out the calendar. one of the weather forecasters I follow is suggesting Winter may be on the drier side before extensive, widespread rainfall in Spring.

- Who knows what the weather will do, but let’s assume this scenario plays out, the reason I’m doing this is to highlight the benefits of locking in a price on sale or bought cattle and hedging forward sale or purchase prices.

- I see further pressure placed on the market by finished and feeder buyers in winter, with producers choosing to offload in the face of a pressured market before recovering later in 2024 –> I’m not saying to the same extent but fundamentally the same way 2023’s market played out.

- A lot of assumptions here but this will mean supply remains high into Winter –> no better time to hedge the cattle you intend to sell than now.

- Same applies to a buy side, no better time to hedge your risk with a wet spring on the cards and a rising cattle market than now, with forward contracts not extending that far out, beyond 3 – 4 months that is.

- Who knows what the weather will do, but let’s assume this scenario plays out, the reason I’m doing this is to highlight the benefits of locking in a price on sale or bought cattle and hedging forward sale or purchase prices.

- Drier conditions are on the cards for southern Australia leading into winter, until a potential late change in May –> think south of Dubbo right across VIC into SA & Southern WA as a general location guide.

- What I believe this means is that cattle volumes out of these areas will continue to flow heavily unless rain stems supply and as a result of the drier start to winter, prices will most likely come under pressure.

- We may continue to see Queensland buyers remain in the south further into winter, purchasing cheaper stock and getting them home at a lower rate than buying out of the QLD market.

PRICE VOLATILITY

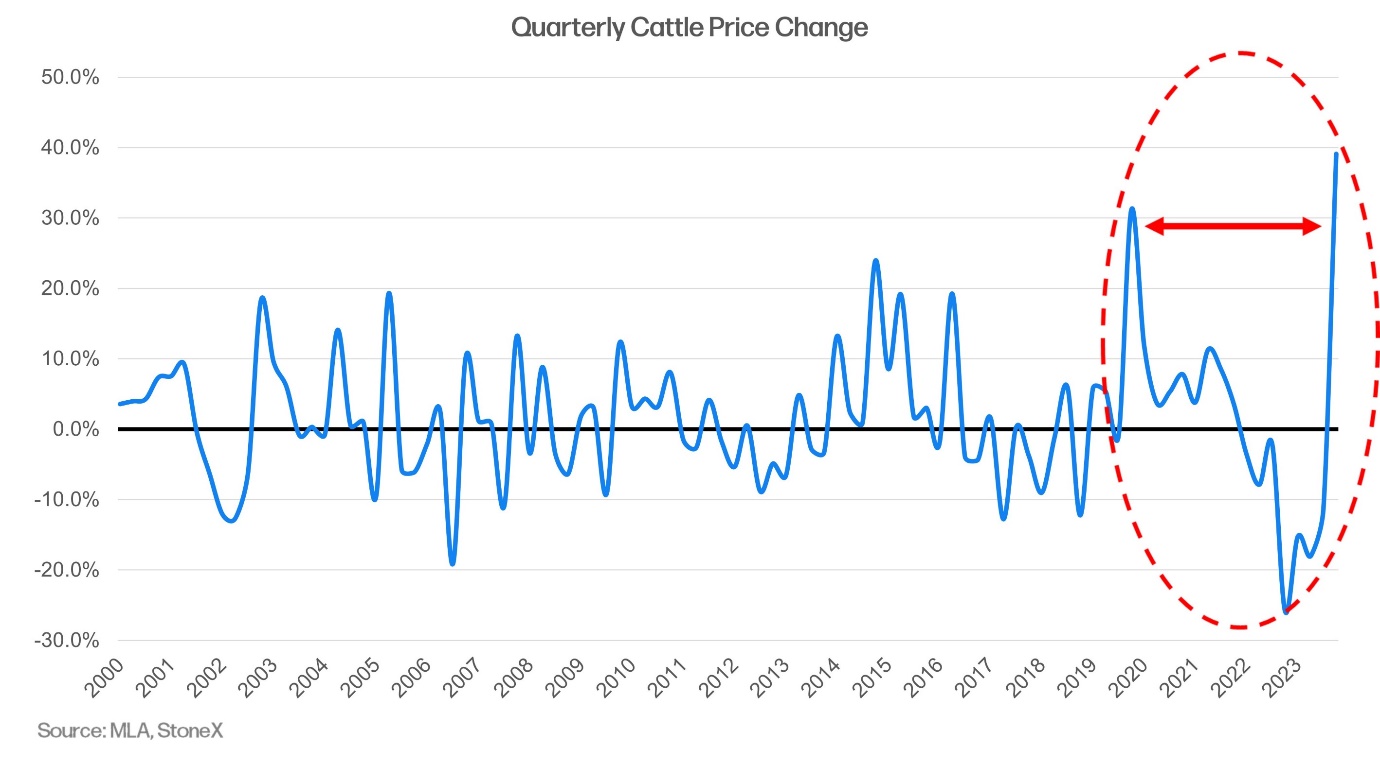

- Now that Q1 2024 is over, pricing data confirms the last 2 quarters or 6 months has been the most volatile period of cattle prices since records began for the NLRS.

- In Quarter 4 2023, the EYCI fell 11% or 57c on Q3 rates whilst Q1 2024 prices on average were 39% or 175c/kg cwt higher than Q4 2023.

- These price changes (although it’s the EYCI the same applies for the broader market) demonstrate how much risk and volatility Australia’s cattle market carries.

- This applies to both producers selling cattle for a lower value over time and conversely, buyers having to buy more expensive cattle because the market rises…

- If the red circle doesn’t make you sit up and notice the extent of volatility the market has experienced over the last 4 years and as such the risk the market carries, I don’t know what does.

- Again, the StoneX Cattle Swap can potentially help both buyers and sellers of cattle manage this risk and look to mitigate it to ensure their business can remain resilient to fluctuating markets.

- Again, the StoneX Cattle Swap can potentially help both buyers and sellers of cattle manage this risk and look to mitigate it to ensure their business can remain resilient to fluctuating markets.

SUPPLY

- National yarding’s back to their third highest weekly volume for 2024. This was the highest yarding volume in 2 months, the tipping point when the first market correction of 2024 began.

- Slaughter recovered strongly as expected, 131,000 processed last week based on NLRS (closer to 160,000 for the week) –> paddock cattle volumes flowing freely last week assisted this.

- I think we’ll see slaughter beyond 140,000 per week (in NLRS terms) in May, meaning actual volumes should push above 170,000.

- Add 20% to the weekly NLRS volume and you’ll get the accurate figure – since Q2 2020 NLRS to ABS difference has been 20% –> this difference can be explained by processors not submitting figures to MLA (it’s a voluntary report).

- May is typically the seasonal peak in slaughter volumes for a calendar year – although I expect winter to be relatively strong this year.

- General paddock supply has been very strong, reducing demand to fill either feedlot or kill space via the yards – thus pushing prices down.

- Saleyard supply moving forwards –> a softening leading into the end of April before a strong month of May is where I see it heading.

- The caveat to all of this is weather, I’m expecting strong May volumes assuming the month in terms of rainfall is average & if continual pressure is placed on prices driving higher turnoff, particularly for those lacking feed.

- With ANZAC day next Thursday and rain potentially affecting some supply areas, numbers should generally soften. The following week higher supply on the cards again though.

PRICE

- A little bit of pick your poison this week, all categories softened, just depends on which end of the market and what state you’re in defined what fell further…

- Restockers were the least affected nationally while processor cows lost all of the improvements it’s made in the last 4 weeks to fall to its lowest level since the bottom of the first market correction for 2024 in late March.

- With processor cows down 36c/kg lwt this week, some may wonder how, considering the demand for imported 90’s in the US which I and many others have been discussing recently, how prices could fall so much.

- Processor margins on these cheaper cows selling into a very strong US market would ensure profitability on the trim remains strong –> balancing supply or kill rosters between cows and other animals would be a consideration and with good supply of PTE and cast for age cows out of the paddock, saleyard prices came under pressure naturally due to the lower need to source saleyard cattle to fill kills.

- Next week –> I see further downward pressure on prices, why, because producers will want to get in and sell before the market falls further (reinforcing this market behaviour dynamic I’ve mentioned a lot this year).

- Feeder and finished buyers will continue to place downward pressure on the market –> supply will be used as the reason.

- This weather system mentioned below may mean otherwise, more so for specific regions rather than widespread price changes.

- The longer-term issue here will be people wishing they’d done something sooner if supply pressure and drier conditions force prices lower into winter, the swap can potentially be the solution to this scenario in front of us, even small volumes is starting the journey to actively managing price and market risk.

Source: Meat & Livestock Australia

WEATHER

- BOM called the end of El Nino on Tuesday.

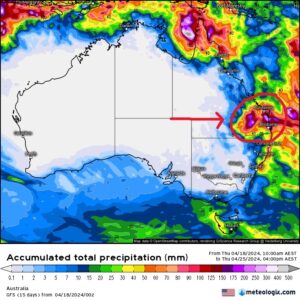

- In the short term, a large front of the northeast of the country, coupled with a developing trough in the interior of is looking increasingly likely to deliver rains right along the eastern seaboard into SA over the coming week to 10 days towards the end of April.

- IF it eventuates, this will create further headaches for processors and accessibility to cattle (see Southern Queensland circled in red below), there may be a further softening in slaughter on top of the already shortened week next week (which we won’t find out about until May 1).

- As a result of this system, prices may find some support in the short term before May, which I believe will be short lived. Feeder and finished buyers are going to use supply as the lever to drive prices down and restockers will follow suit when they see feeder/finished prices fall on the weight of supply when conditions dry out again –> its seesawing like a Yo-Yo.

- IF it eventuates, this will create further headaches for processors and accessibility to cattle (see Southern Queensland circled in red below), there may be a further softening in slaughter on top of the already shortened week next week (which we won’t find out about until May 1).

- Current sea surface temperatures (SST’s) are conducive to late season cyclonic activity occurring for northern Australia.

- Currently models have been slow to react to the northeast front off the coast of Queensland and are yet to pick up the inland trough due in the next 10 days –> or further out the calendar the potential cyclonic activity for the north… see GFS forecast for the week ahead below.

Source: meteologix.com

Source: meteologix.com

Kind Regards,

Report by Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61-427-796-984

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

Revised Disclaimer for SFPL

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727) (“SFPL”) is a member of the StoneX Group Inc., group of companies. The StoneX Group Inc., group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC. (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX Financial Ltd (“SFL”) is registered in England and Wales, Company No. 5616586, authorized and regulated by the Financial Conduct Authority [FRN 446717]. StoneX Financial Pte. Ltd. (“SFP”) (Co. Reg. No 201130598R) holds a Capital Markets Services Licence regulated by the Monetary Authority of Singapore for Dealing in Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading. SFPL holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646). StoneX Financial (HK) Limited (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Futures Contracts. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors.